Resiliency of remittances

But a recently released report by the IOM Regional Office for Asia and the Pacific (ROAP) and ROAP'S Regional Data Hub found that many of the dire forecasts did not materialize. The IOM study collected remittances data from Central Banks in 2020 across 12 Asia Pacific countries and showed that while remittances did drop in some parts across the Asia Pacific region, remittances demonstrated incredible resiliency as has been the case during previous crisis.

During 2020 and the beginning of 2021, experts kept revising their predictions downward as more data became available. The newest data on remittances were released by the World Bank in May 2021. The IOM report reflects much of these new data.

A decrease in remittances affects the most vulnerable

Among the impacts of COVID-19, a main concern is that a significant decrease in remittance flows could push migrant dependent households below the poverty line.

Migrant remittances have historically served as an important lifeline for many households. Families rely on remittances to increase their access to important public services such as education and health care. Less talked about are the macroeconomic contributions of migrant remittances; these are critical during challenging economic times because although remittances are private funds that are not originally intended to support governments, they enable central banks to build up months of foreign currency reserves to help cushion economies against “shocks” such as a COVID-19 induced recession.

Impact of COVID-19 on remittances in the Asia Pacific region

The full IOM ROAP study is available here and sought to answer the following questions:

- Whether remittances in the selected countries “show counter-cyclical patterns” as might be anticipated during a crisis;

- Acknowledge what impacts, if any, currency fluctuations may have had on the 2020 data;

- Identify new trends/patterns the impact of COVID-19 may have on key remittance corridors (for example United States to the Philippines);

- Examine demonstrable impacts on remittance channels (eg, rise in mobile money transfers, usage of informal channels, among others); and,

- Examine the impact of any public policies implemented by national governments to incentivize remittance flows.

Brief findings from Nepal, the Philippines and Fiji

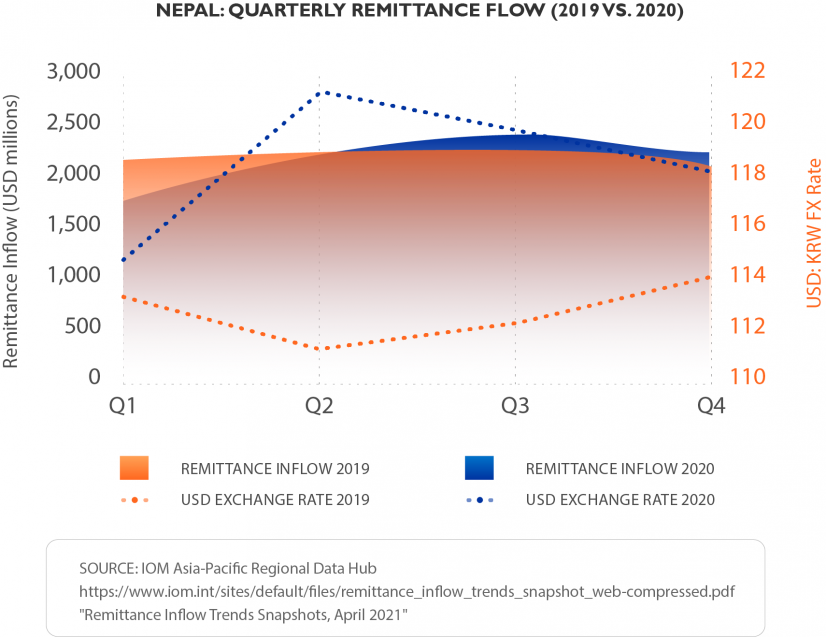

Nepal

- While the World Bank predicted a 22% decline in remittances to South Asia in April 2020 and a revised estimate decline of 4% in October 2020, Nepal’s total remittance inflows represented only a 2.5% decline from the previous year.

- Remittance inflows did not drop as dramatically as expected, largely due to increases in formal remittances as informal flows were impacted due to movement restrictions and lockdowns.

- The stability of remittances in Nepal has also been attributed to an uptick in formal remittance channel usage, as informal money transfer service providers (known as hawaladars) could not travel as easily with cash due to COVID-19 restrictions.

- The Nepali Government introduced a digital wallet service to provide online remittance services during the pandemic for Nepalis living abroad.

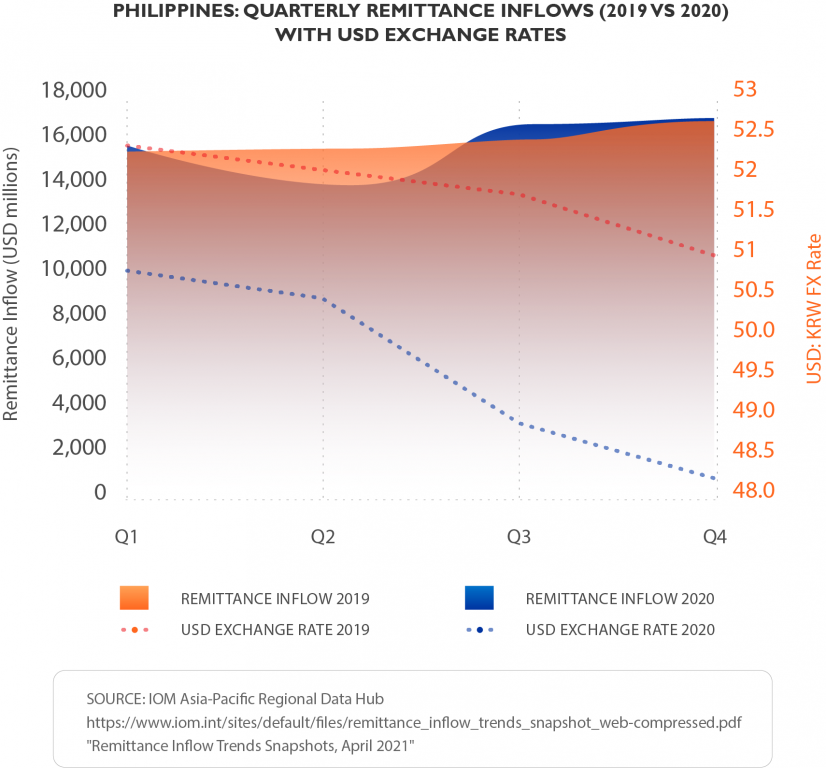

Philippines

- Remittance inflow variance can be attributed to the response of host countries to the COVID-19 lockdowns, with many workers returning home.

- Remittance beneficiaries also received less peso value due to its appreciation against the US dollar, forcing overseas Filipinos to send home more remittances in dollar terms.

- The Philippines experienced a 0.8% decline in annual remittance inflow from 2019 to 2020, despite the Filipino Central Bangko Sentral ng Pilipinas’ (BSP) predictions of a 5% decrease.

- Despite the Philippines economy in full recession, remittances remained surprisingly stable over 2020.

Fiji

- Fiji’s annual remittance inflow increased by 10.9% from USD 272 million in 2019 to USD 301 million in 2020. This was despite an initial drop in remittances in the first few months of the pandemic.

- Vodafone Fiji saw an increase from 6,500 transactions per month with a value of USD 900,000 before March 2020 to 22,000 transactions in May 2020 with a value of over USD 3.1 million.

- Inflows of remittances through mobile money platforms increased by 279% from January to October.

- Pacific nations have benefitted from donor-led incentives to encourage use of mobile channels. As a result, remitters were able to use a wide variety of digital services at reduced prices, leading to higher remittance inflows.

COVID-19 has exacerbated the vulnerabilities of many migrants. However, when we consider the socioeconomic hardships that migrants have faced since the pandemic started and then juxtapose this with the resiliency of migrant remittances findings from our study, we are reminded again of the ingenuity, capacity and determination of migrants and far from being victims of circumstance – migrants are in fact drivers of a lot of development globally,